- Clean Up the Financials

- Some adjustments (“add-backs”) for EBITDA / Cash Flow are okay and others are not

- Adjustments must be easily identifiable and provable

- Consistency in accounting approach from year to year

- Ability to track revenues and costs by customer, services, products…etc.

- Internal financials should be easily footed to tax returns

- Buyers will want to see at least a three year history of solid financial performance

- Establish a Plan for Predictability and Sustainability of Earnings and Future Growth

- Customer contracts

- Pattern of recurring revenue and backlog

- Unique product or service and barriers to entry

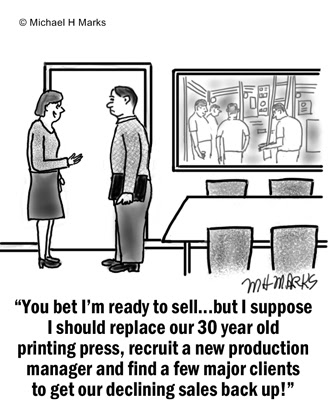

- Address or Remedy Deficiencies or Issues that May Affect Valuation

- Customer concentration

- Employee issues (non-competition agreements, golden handcuffs, employee vs. independent contractor)

- Negative or declining revenue or profit

- Update technology and equipment

- Environmental issues

- Delegate

- Move key functions and customer relationships away from the owner(s)

- Establish a reasonable management infrastructure

- Establish and document operating procedures

- Yearly Business Valuation

- Understand the metrics and drivers for value

- Adjusted EBITDA or Seller’s Discretionary Earnings (SDE)

- Multiple of what metric?

- Working Capital – included or not?

- Deal Structure (cash, promissory note, earnout…etc.)

- Understand and Prepare for Tax Implications

- Asset sale vs. stock sale

- Capital gains vs. ordinary income

- Start the Planning Process Early

- Years not months ahead

- Learn More About the Target Market and Financing Options

- SBA bank financing

- Private Equity money

- Strategic buyer

Talk to one of our professionals to see where your business stands today and how much preparation would be required in order to achieve the best possible results in the marketplace. There is no cost or obligation for you to get informed and you might be surprised how much your business is worth. Call us today at (610) 325-7066 or simply contact us here. All inquiries are kept in the strictest of confidence.