A key component to selling your business for a favorable price is keeping your financial paperwork up-to-date, and making sure it accurately reflects your company.

If you’ve been managing your business for years, it’s likely you’ve added new products and services. It’s necessary to keep track of those as you go and make sure there is paperwork that clearly shows budget and income adjustments that reflect any and all changes, to keep your buyer informed.

Cash flow problems and mismanaged finances are the main cause of business failure, so qualified buyers will want to see evidence of a well-maintained budget.

Plan Your Financials for the Future

The first step is to develop a rough framework to project your financials into the future. This could mean developing a loose plan similar to the one below:

- 50% of revenue on expenses (payroll, supplies, etc.).

- 30% of revenue on building the business (updating equipment, recruiting new employees, etc.).

- 20% on future products or services.

Take Copious Budget Notes

After you set up your plan, go about business as usual, but be strict about keeping track. Some accounting software should make it easy, especially if it tracks inflows (sales) and outflows (accounts payable).

As the months go by, you will be able to notice any patterns and adjust as needed.

Make Adjustments and Watch Out for Sneaky Money-Wasters

Very few businesses are able to maintain absolute consistency, so don’t feel too bad if your finances have major ups and downs.

If you consistently have a problem at a certain time of the month or year, you could make a few simple changes like:

- Making sure to keep your business credit nice and high so you can access short-term money in a pinch.

- Shortening your payment terms to get clients to settle bills more quickly.

- Rescheduling the payment dates for your suppliers.

- Getting rid of any product that is sitting in the back of a warehouse, costing you space and money.

While you’re at it, make sure you aren’t guilty of any sneaky ways that you could be losing money. Ways to combat these include:

- Evaluating all available payment options. There are positive and negative points to credit cards, cash, and PayPal, so be sure to thoroughly consider each.

- Educating yourself on hidden fees and costs, like maintenance or damage, before buying or renting equipment.

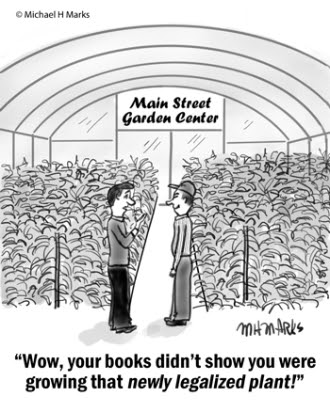

- Staying in-the-know regarding tax legislation, insurance requirements, and retirement fund financing.

- Paying your bills on time, in order to avoid interest or a negative impact on your credit score.

Make Sure Your Financial Records Match Up with Reality

The core goal of any business is to make money, so managing your finances needs to be a priority. Potential buyers will be impressed if you have a well-maintained record of finances, but only if they’re accurate!

If you’re getting ready to sell your company and need some help getting things together, feel free to contact The Bridlebrook Group.