Value is always a pivotal factor in a business owner’s decision to sell. There are frequently additional motivating factors such as retirement, health, business opportunities, stress, and a variety of others, but they are usually coupled with an ability to obtain the right price and terms for the business. At no cost or obligation, we provide an analysis on the business that covers value and other market realities so you know exactly how much your business is worth. We do this to help a business owner make informed decisions before making any commitments to market and sell the business.

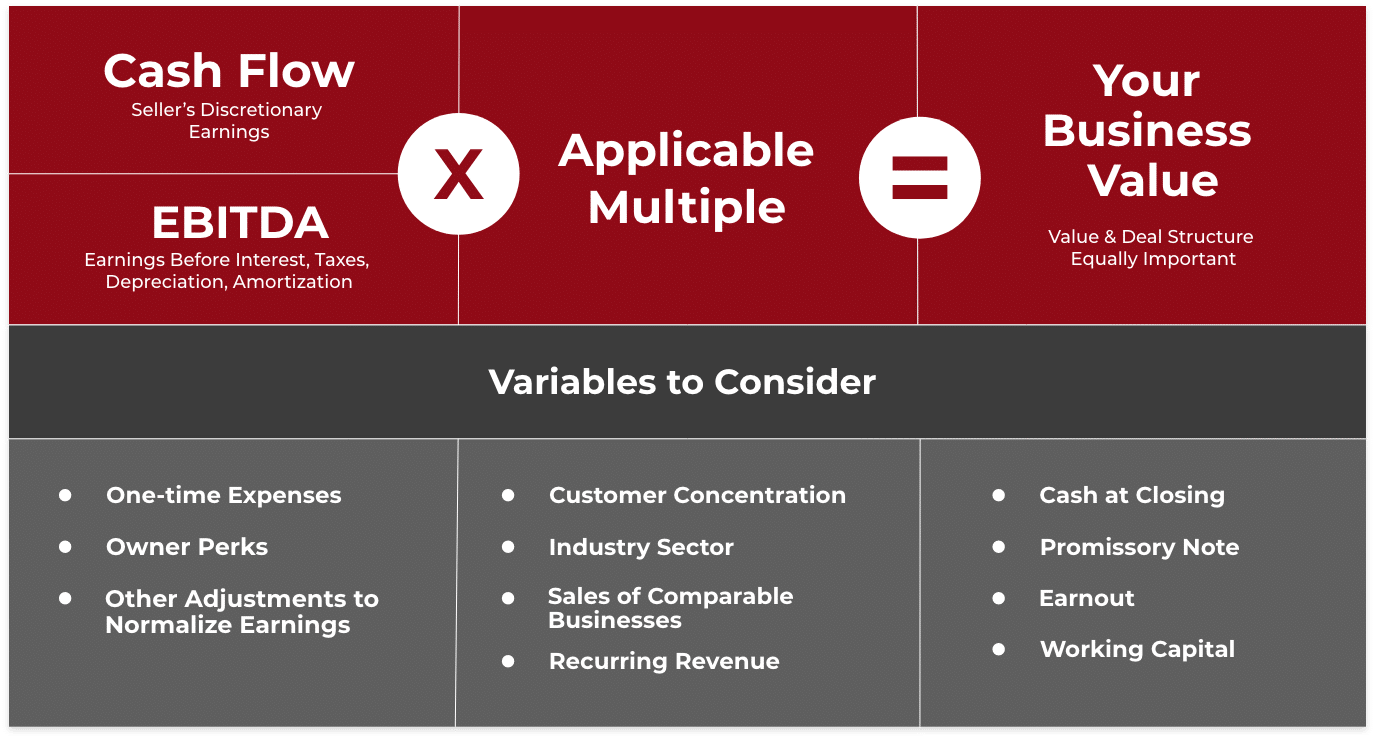

This process starts with an introductory and confidential phone call or meeting to cover some basics. From there, we will review the last 3 years of annual financial information, typically in the form of internal profit & loss statements and balance sheets, federal income tax returns, or accountant prepared financial statements. We will recast your financials to demonstrate the true profitability, which will directly impact the value and marketability of your business. Since businesses are bought and sold based on multiples of EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortization) or SDE (Seller’s Discretionary Earnings), this is a critical step. Once the analysis is complete, we will schedule a time to follow up with you to discuss value, the process, and your best alternatives. Again, this exercise and consultation come at no cost or obligation.

Find Out What Your Business is Worth

Would you like to know how much your business is worth? To find out, call us at (610) 325-7066 or simply contact us here. All inquiries are kept in the strictest of confidence. Our Philadelphia area business brokers work with businesses in Pennsylvania and beyond, including Delaware, Maryland and New Jersey.

You can also find answers to frequently asked questions from sellers to get started.