Well before you prepare your business for sale, it’s important that you keep track of your financial records and compare them year over year. When reviewing your documents, keep your eyes peeled for red flags that can indicate poor business health. You’ll want to do whatever you can to repair these issues, as they could hinder the sale of your company. Keeping an eye on financials will make your business more profitable and ultimately create greater value when you decide to sell.

8 Things Buyers Will Look for When Analyzing Your Financial Statements

Potential buyers will closely review your financials when determining whether or not they want to purchase your business. Before they have the chance to scrutinize the numbers, be sure to look out for these 8 red flags that could be hiding in your financial statements.

- Revenue has Been Declining: If your business revenue has been declining for several years, it’s time to search your budget for places to cut spending.

- Continuous Increase of Debt-to-Equity Ratio: If your debt-to-equity is steadily increasing, that means your business is taking in more debt than it can comfortably shoulder. If yours is higher than 100%, it’s time to make some serious adjustments. You should also be worried if your coverage ratio is less than five. Calculate that by dividing your net interest payments by operating earnings.

- “Other” Expenses that Account for a Good Deal of the Budget: Many organizations categorize some of their spending under “other.” Though items in this category are typically small and difficult to categorize, sometimes larger purchases sneak their way in. If you notice any large costs, work to figure out what they are and whether they are recurring.

- Higher Liabilities than Assets: This one varies depending on the type of business you own. For example, if you own a landscaping business, you will almost always go through periods in the winter when your liabilities are higher than assets. However, if you consistently gain more liability without increasing assets, that could spell trouble.

- Accounts Receivable or Inventory is High When Compared to Sales: If your budget has high amounts of cash that is getting held up in accounts receivable or is being used to purchase inventory, that money isn’t going to generate a return. Inventory is important, but you don’t want a large amount of revenue hiding out in warehouses.

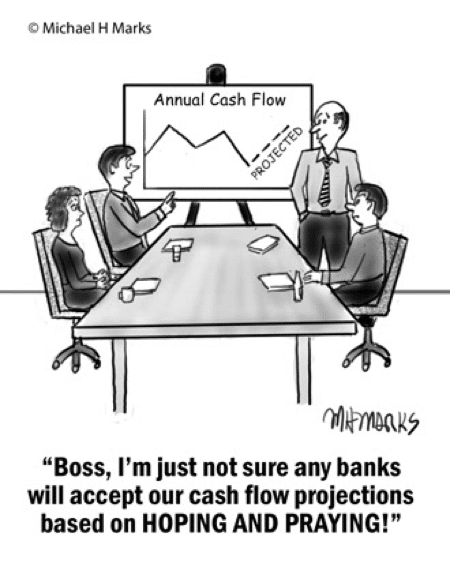

- Inconsistencies in Cash Flow: The best sign of a healthy business is regular cash flow. If you have a stock pile of cash at some points, that could indicate that while accounts are being settled, there isn’t a great deal of new work coming in. On the other hand, if your cash flow is on the low end, this could mean that you are underbilling for work.

- Gross Profit Margins on the Decline: This statistic measures the ratio of costs to profits over an extended period so, naturally, if it is consistently on the decline, that is cause for concern. Keep in mind that in addition to tracking the costs of producing your business’s service or product, you need to add in operating expenses and debt.

- Outstanding Share Count on the Rise: If your share count hovers around two or three percent, that means you’re selling too many shares, and that this is watering down your organization’s value.

Address Financial Health to Prepare Your Business for Sale

Potential business owners want to purchase healthy businesses, so if your company is showing any of these common red flags, it’s time for them to get some extra attention. Not sure where to start? Contact The Bridlebrook Group and we’ll walk you through it.