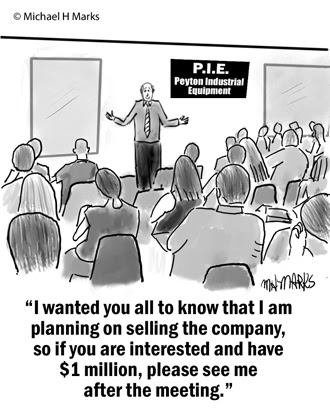

Though it seems like a basic and logical solution, it isn’t all that simple. There are benefits to selling your business to someone you know and trust, but there are also a number of complicating factors.

Benefits to Selling a Business to an Employee

- Potential for Increase in Employee Morale: When working for an owner who is nearing retirement, employees may begin to grow concerned for their job security. When they see someone they’re used to working with take over the business, it will help maintain continuity for them. If the employee who buys the business is well-respected by employees, the morale of the entire company may get a surge of new energy.

- Little Disruption to the Company: If your business transfers to someone who has worked for your company for years, they will need little training. They will likely have good ideas for implementing strategy and be able to put them into practice with few snags. To employees and clients, the new management will step up and there won’t be an abrupt change.

- Ease of Transition: Assuming good management practices are in place already, little effort will need to be exerted to train a new leadership team. From a legal perspective, an internal transition of ownership can be easier to accomplish than an external one.

Drawbacks to Selling a Business to an Employee

- Possibility of the Deal Falling Through: There are many reasons why would-be business owners need to back out of a deal at the last minute. This is disappointing, but when it happens with a personal friend, it can add an uncomfortable layer. If the deal falls through, the employee may live to resent the new owner and could break the confidentiality agreement.

- May Require Increased Involvement: When a business is sold to an insider, these kind of transactions are often gradual. As your duties slowly fade out over time, you may need to be more involved with the business’s transition than you would like.

- Difference in Structures of Sale Proceeds: When dealing with these types of transactions, the amount of proceeds you receive often depend on the success of your business, so the sale is a gamble. You also will not typically receive all of the payments at once, but in several installments over a period of time.

Selling to someone you have a personal relationship with can be good, since you trust the person; but also bad, since it can throw a wrench in the personal dynamic you have with this individual.

The bottom line is that you should consider all of the pros and cons before you make your final choice. If you have any questions, don’t hesitate to contact The Bridlebrook Group, either online or by dialing (610) 325-7066.